Whether you’re working from home because of the COVID-19 pandemic, you generally operate your business remotely, or you’re an employee of a firm that works both from home and in-office, you’re entitled to claim home office deductions for the home office expenses that you have incurred this year.

The office furniture that you have set up in your home office plays a fundamental role in the successful completion of your tasks and how you operate while working from home. What’s more, working from home will incur additional expenses like electricity, heating, cooling and internet.

As it stands, we’re smack bang in the middle of a global pandemic. With the continuing restrictions and social distancing laws, more employees and freelancers have found themselves having to complete their work from their homes than ever before. This means that more people are spending more money on office furniture, equipment and general operating expenses than ever before. If you’re reading this article, you’re probably wondering “Can I claim home office expenses?”

Can I Claim Home Office Expenses?

In short, yes. If you’re working from home, you will be able to claim home office expenses. In fact, if you rely on a full home office set up to facilitate working from home, chances are, you’ll be able to claim most of your work-related expenses when it comes to tax time.

Home Office Deductions

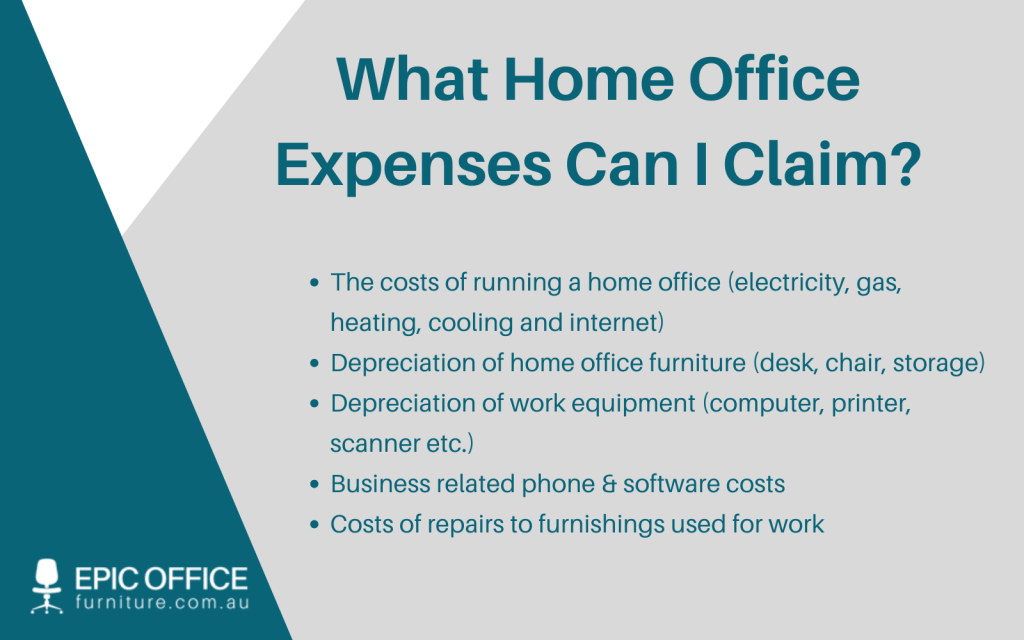

If you have a home office set up, there are at least five home office deductions you should know about. These are general home office operating expenses and include:

1. The Costs of Operating A Home Office

If you’re working from home, you’re going to inevitably use heating, cooling, lighting and power. That means that you can claim a proportion of the various household utility bills which relate to the time spent working in your home office. As long as you are able to show proof with records, you will be able to claim the costs of household bills that can be attributed to working from home.

2. Depreciation of Home Office Furniture

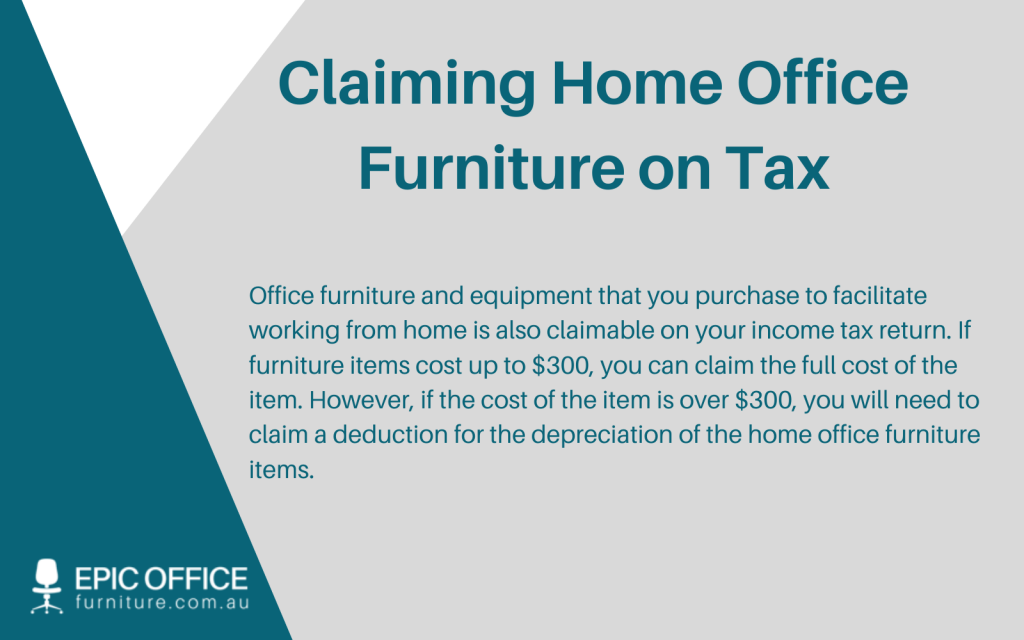

Office furniture and equipment that you purchase to facilitate working from home is also claimable on your income tax return. If home office furniture items cost up to $300, you can claim the full cost of the item. However, if the cost of the item is over $300, you will need to claim a deduction for the depreciation of the home office furniture items.

If you’ve set up your home office with a desk, office chair, storage and organisational furnishings, you can claim a deduction for the decline in value of these assets. Whether it be a new office desk, ergonomic chair, workstation or filing cabinet; if the item is over $300 and is a depreciating asset, it can be submitted in a tax deduction claim. As long as your office furniture items relate directly to work activity, you can work out how much it’s declined in value from the moment they were purchased for claiming home office expenses.

Home office furniture items for tax deductions generally include:

- Office Desks

- Office Chairs

- Monitors/ Screen mounts

- Keyboards

- Webcams

- Storage

- Filing Cabinets

- Headsets

3. Depreciation of Work Equipment

Similarly to the depreciation of home office furniture, the technical equipment purchased to successfully work from home can be deducted from a tax claim for home office expenses. This includes things like your computer, desktop, printer, scanner etc. If you want to claim home office deductions for these assets that typically costs more than $300, then it depends on the effective life of the asset. For example, a laptop generally has an effective lifespan of 2 years, so it will normally be written off over two years.

4. Business Related Phone and Internet Costs

If you are required to use your mobile phone and the internet for work (which most employees are), you can claim a tax deduction on the expenses of phone and internet bills. Subscriptions and home office software updates like Microsoft Office and Adobe may also be tax-deductible when claiming home office expenses. As long as you can substantiate these claims with phone bills, internet bills and bank statements, business-related tech and software expenses should be fully deductible.

5. Costs of Repairs to Furnishings Used for Work

If you need to have pieces of office furniture repaired or fixed in your home office, you may claim the expenses directly related to these services. You may also claim the expenses relating to cleaning a dedicated workspace and home office as one of your home office deductions.

Claiming Home Office Expenses

There are three main ways that those working from home can claim the associated expenses on tax:

- The fixed-rate method

- The actual cost method

- The shortcut method

The fixed-rate method involves claiming a flat rate of home office deductions of 52 cents per hour worked from home to cover the costs of electricity, gas and the decline in value of furniture and any repairs. For this method to be applicable, there needs to be a dedicated work area, whether it be a home office, converted bedroom or shed: the main key is that the area is used purely as a home office.

The actual cost method involves claiming the actual expenses directly incurred while working from home. This means looking at the cost of power per kilowatt and the number of hours equipment is used. This option is suited to those who have a meticulous record and can keep track of home office usage.

Finally, the third method is the shortcut. Back in April, the tax office announced the shortcut methods for claiming expenses incurred from working from home due to the COVID-19 pandemic. Given that many that have been forced to work from home do not have a dedicated home office, the shortcut method is perfect for claiming expenses for those who are working in shared living spaces in their homes like kitchens and living rooms.

How Can I Claim Home Office Expenses in 2020?

Given that we are amid a pandemic, there have been some changes to tax claims and deductions for 2020. So many of us are now required to work remotely, and thus, we’ve had to rely on different working environments more than ever during the Coronavirus epidemic.

Back in April, the ATO announced a new method for claiming expenses for those working from home due to COVID19. The ‘shortcut method’, refers to 80 cents per hour covers all of your work-related expenses while working from home. This method is only valid for working from home expenses incurred between 1 Mar – 30 Sep 2020. The shortcut method means that during this crisis, those having to set up impromptu office spaces within their home are able to lodge their appropriate claims.

Tax Claim for Home Office Furniture

Well, there you have it. The answer to the question of “can I claim home office expenses on tax?” is yes. However, how much you may have deducted from your taxable income will depend on the type of claim you lodge, and how you’re able to keep track of your home office expenses. In the case of filing a tax claim for home office furniture, keep your receipts, and you’ll be eligible for home office deductions. If your home office furniture expenses are less than $300, you can claim the full amount. If your home office furniture costs are above $300, you’ll be able to have the depreciation in value deducted.

Epic Office Furniture

Looking for new home office furniture to kit out your working from home set-up? You’ve come to the right place. Epic Office Furniture is the leading online retailers for the best home office furniture and equipment in Australia.

From our office chairs to our desks and organisational accessories, we’ve got every piece of equipment you could possibly need to furnish your home office. What’s more, you’ll be able to work in comfort and style, rest assured that the office furniture pieces are eligible for tax home office deductions! If you have any questions about our furniture, do not hesitate to get in touch with one of our friendly team members at Epic Office Furniture today.

*This is general information only and does not constitute taxation or legal advice. Seek professional tax and/or legal advice to determine whether you are eligible to make a tax deduction claim for any purchases.